Social Security Earnings Limit 2025 Chart

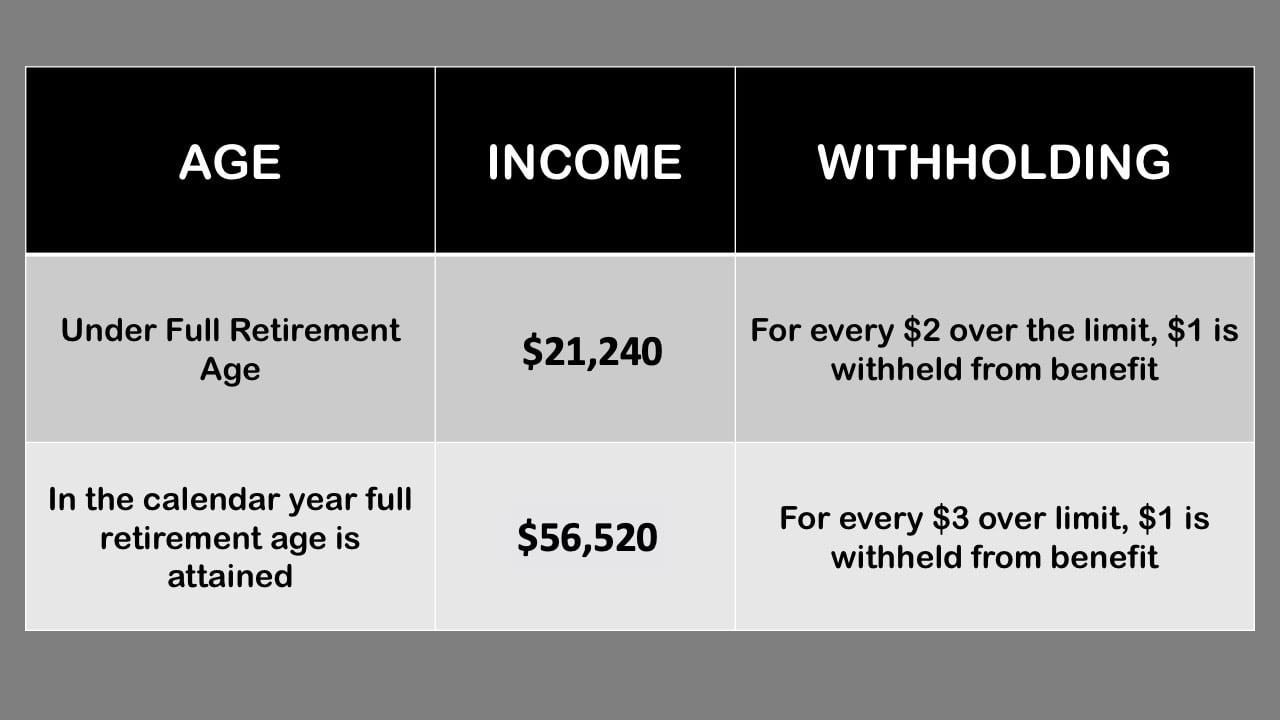

Social Security Earnings Limit 2025 Chart. There is no earnings cap after full retirement age. Benefits in 2025 reflect subsequent automatic.

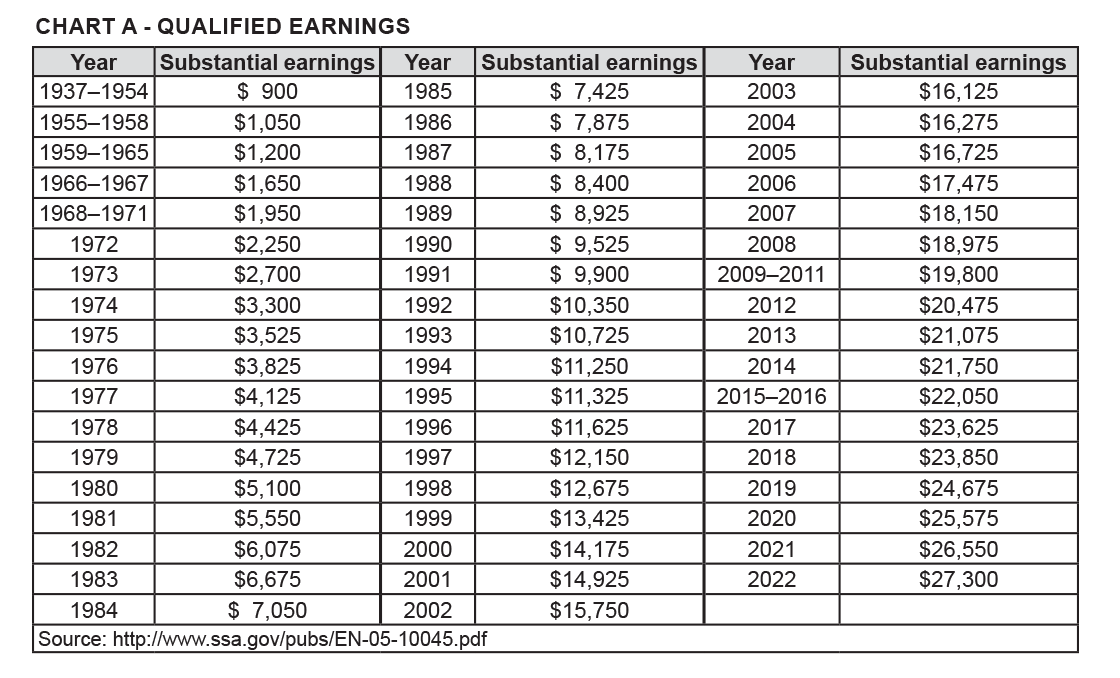

We call this annual limit the contribution and benefit base. A zero is used for each year without earnings to compute average indexed monthly earnings and in each year only earnings up to the social security wage base are counted.

Social Security Earnings Limit 2025 Chart Images References :

Source: sammacdonald.pages.dev

Source: sammacdonald.pages.dev

Annual Limit For Social Security 2025 Sammac Donald, Spousal benefits are calculated on the primary.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

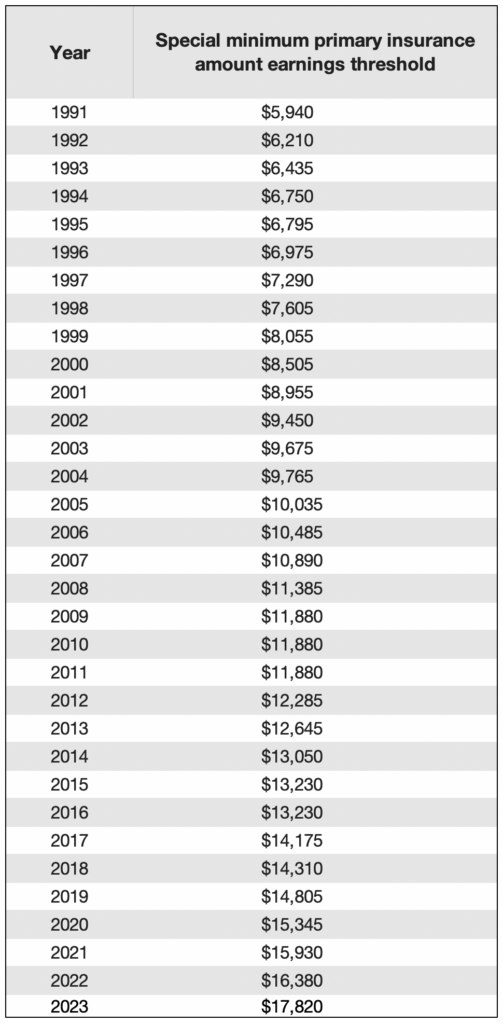

What is the Minimum Social Security Benefit? Social Security Intelligence, In 2025, the taxable income limit for social security will rise from $168,600 to $176,100.

Source: www.ohsers.org

Source: www.ohsers.org

Social Security SERS, Currently, you can earn up to $22,320 without having your social security benefits withheld.

Source: nataliaskye.pages.dev

Source: nataliaskye.pages.dev

Social Security Limit 2025 Increase Natalia Skye, A zero is used for each year without earnings to compute average indexed monthly earnings and in each year only earnings up to the social security wage base are counted.

Source: clarapaige.pages.dev

Source: clarapaige.pages.dev

2025 Maximum Social Security Tax Clara Paige, This adjustment may sound very small, but it actually has a direct impact on millions.

Source: thomaszeeshan.pages.dev

Source: thomaszeeshan.pages.dev

Social Security Max 2025 2025 Thomas Zeeshan, The social security tax is calculated as a percentage of your gross earnings, but only up to a specified limit.

Source: firasameen.pages.dev

Source: firasameen.pages.dev

Social Security Withholding Limit 2025 Firas Ameen, In 2025, that threshold is.

Source: www.ohsers.org

Source: www.ohsers.org

Social Security SERS, In 2025, that threshold is.

Source: joaquintheo.pages.dev

Source: joaquintheo.pages.dev

Social Security Tax Limit 2025 Calendar Joaquin Theo, A zero is used for each year without earnings to compute average indexed monthly earnings and in each year only earnings up to the social security wage base are counted.

Source: ricklsanchez.pages.dev

Source: ricklsanchez.pages.dev

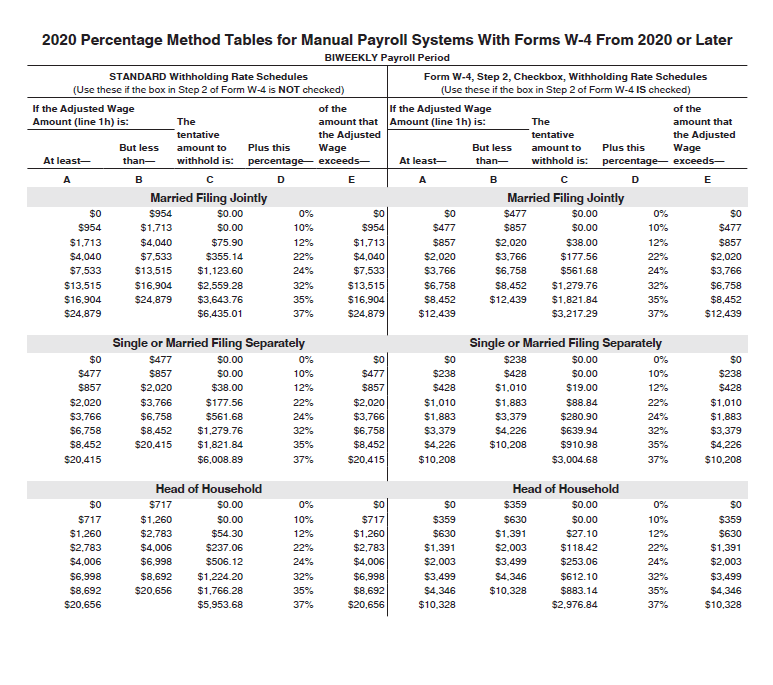

Social Security Withholding 2025 Percentage Chart Rick L Sanchez, Bigger benefit checks, thanks to a cola.

Posted in 2025